P-53

QT-6600 Programming Manual

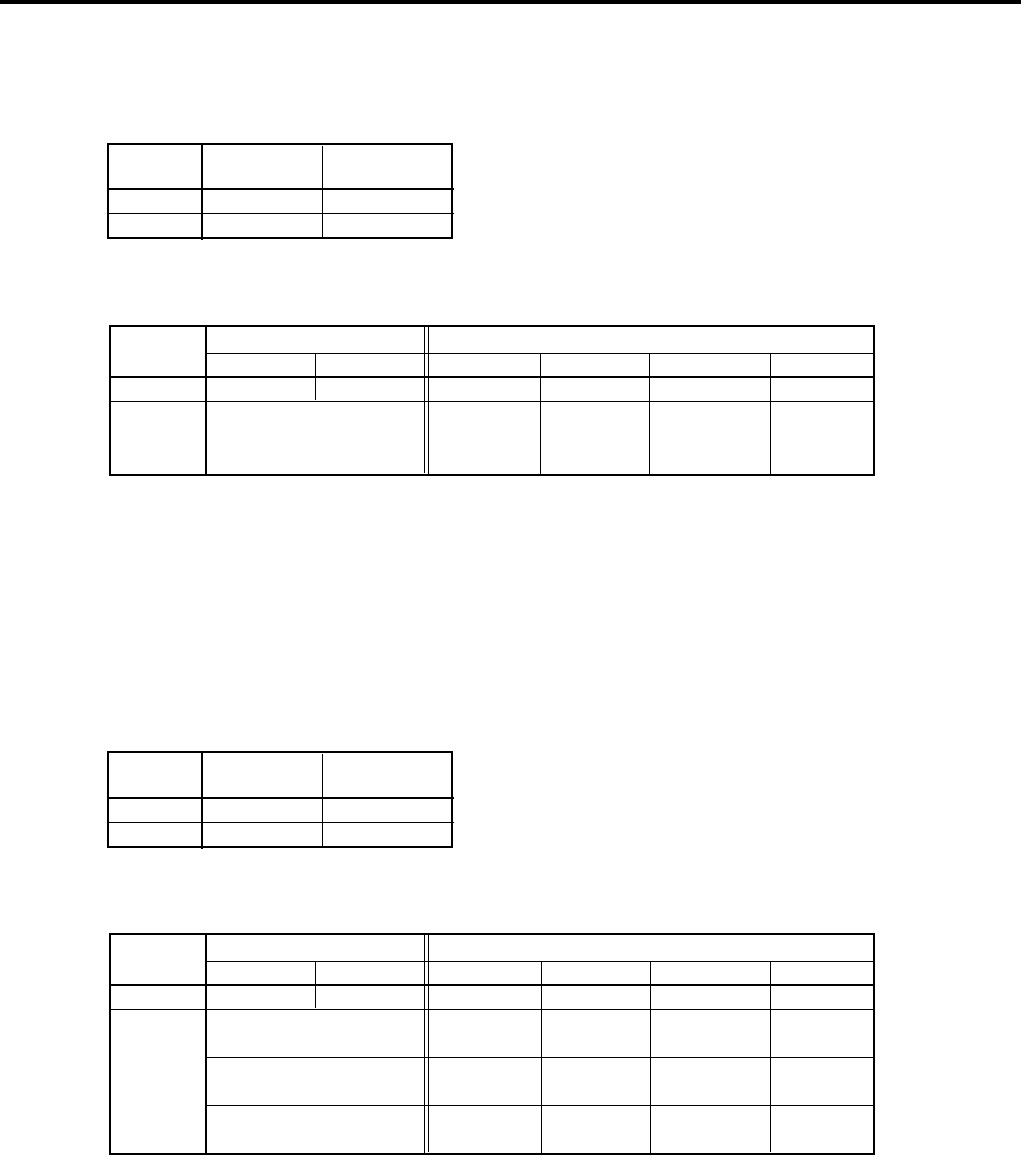

Explanation of Add-in (VAT on Tax)

Example:

Tax table programming

Item programming & registration result

Tax rate Calculation

type

Table 1 10.0000% Add on

Table 2 5.0000% VAT on Tax

Program Registration result

Unit price Tax status Taxable 1 Tax1 Taxable 2 Tax2

Item 1 $10.00 1/2 $10.00 $10.00

Calculate tax 1 $10.00 $1.00 ----- -----

CASH Add tax 1 to Taxable 2 $11.00 -----

Calculate tax 2 $10.48 $0.52

Explanation of VAT & VAT2

Example:

Tax table programming

Item programming & registration result

Tax rate Calculation

type

Table 1 8.0000% VAT

Table 2 7.0000% VAT & VAT2

Program Registration result

Unit price Tax status Taxable 1 Tax1 Taxable 2 Tax2

Item 1 $10.00 1/2 $10.00 $10.00

Calculate tax 1

----- $0.70 ----- -----

($10.00 x 8)/(100 +8 +7)

CASH

Calculate tax 2

----- ----- ----- $0.61

($10.00 x 7)/(100 +8 +7)

Taxable 1/2 - Tax 1-Tax2

$8.69 $8.69

($10.00 - $0.70 - $0.61)